Tornado damage to your home property? It’s like Mother Nature’s throwing a tantrum and your building’s the piñata. First, the winds come in, rip the roof off like it’s peeling a sardine can, and BAM—water damage everywhere, turning your interior into a soggy disaster zone. Then the flying debris joins the party, smashing walls and windows like it’s auditioning for a demolition derby. Let’s not forget the floodwaters sneaking in, wrecking foundations, short-circuiting electrical systems, and soaking everything you love. The cherry on top? Structural damage that screams, “Yeah, we’re rebuilding from scratch.” Welcome to the aftermath, where you’re stuck juggling pricey repairs, insurance claims, and recovery plans that feel longer than a Marvel movie marathon. Time to bring on a Public Adjuster!

Oh, you want to prevent tornado damage? Cute. That’s like telling a tornado, “Hey, could you not?” But fine, here’s the playbook:

Can’t stop a tornado, but you can tell it, “Not today, Satan!”

There's also some cool innovative tech that’ll at least fight back. First up, aerodynamic building designs—basically making your property look like a sleek race car so wind glides right over it instead of ripping it apart. Then there’s smart materials—we’re talking roofs that can flex without breaking and walls that laugh in the face of debris. Wind-resistant shingles? Check. Storm pods? Yep, mini fortresses that make you feel like you’re starring in a sci-fi bunker movie.

Buckle up, because this is where things get messy.

Well, hold onto your wallets, because it’s gonna sting worse than a tequila shot in your eye. On average, you’re looking at $10,000 to $50,000 for minor to moderate damage. You know, fixing a roof, replacing windows, and un-debri-fying your yard. But if your home went full Wizard of Oz and tried to fly? Oh, baby, now we’re talking six figures—$100,000 or more for rebuilding walls, replacing foundations, and un-flooding your life. And if it’s a total loss? Get ready to swim in the deep end of Who’s Paying For This? (spoiler: it’s probably your insurance). Long story short, tornado damage doesn’t just wreck buildings—it wrecks your bank account too.

Tornado damage falls under windstorm damage, baby. But here’s the catch: if your policy doesn’t specifically cover windstorms—or you live in one of those tornado-prone areas with sneaky deductibles—you might be stuck paying out of pocket. So, work with a Public Adjuster to check that policy like it’s the fine print on a contract with the devil.

Most homeowners insurance policies, like the HO-3, HO-5, HO-7, will cover tornado damage under their windstorm peril—because, let’s face it, that’s what tornadoes do best: blow your house to Oz. Renters insurance, HO-4? Your stuff’s covered, but the building? That’s your landlord’s circus. Condo owners, HO-6? Your personal items are covered, however the building is covered by the association. There is a twist—if you’re in Tornado Alley, insurers might slap you with a windstorm deductible the size of the moon. So, check that policy and prepare to tango with your adjuster when the twister comes knocking.

Reminder that the standard homeowner insurance polices HO-1, HO-2, and HO-8 offer limited coverage compared with HO-3 , HO-5 and HO-7.

Get a free insurance policy review with a Tiger Adjuster Public Adjuster!

Home tornado property damage is often characterized by extensive destruction caused by high winds and heavy rain. Roofs may be torn off, exposing interiors to water damage, while walls and windows can be shattered by flying debris. Floodwaters can infiltrate, damaging foundations, electrical systems, and belongings. Structural integrity may be compromised, requiring significant repairs or rebuilding. The aftermath often leaves property owners facing costly repairs, insurance claims, and long-term recovery efforts.

Each year, 1 in every 20 insured homes file an insurance claim with 98% involving property damage.

(Insurance Information Institute, 2021. Claim average from 2017-2021.)

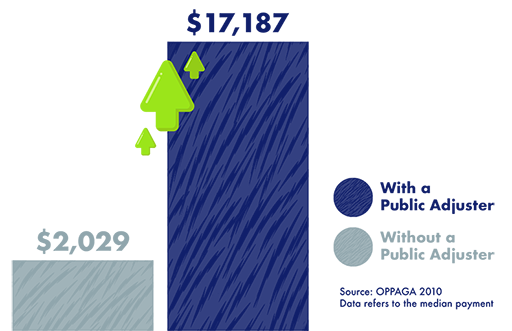

Public Adjusters are licensed insurance professionals trained to interpret your policy, scope and estimate losses, submit your claim, and negotiate with your insurance company to ensure maximum settlement amounts.