Hurricanes and commercial properties—name a messier duo, I’ll wait. Picture this: high winds ripping roofs off like a bad toupee, turning your building’s interior into a soggy nightmare. Flying debris? Oh yeah, that’s your walls and windows auditioning for a demolition derby. And let’s not forget storm surges and floodwaters barging in like uninvited party crashers, wrecking foundations, shorting out electrical systems, and soaking everything you thought you loved. Structural integrity? Say goodbye to that, pal—it’s rebuild or bust. The aftermath? Costly repairs, endless insurance calls, and recovery efforts that make you question every life choice.

Sure, let's grab a magic wand and tell a hurricane, "Hey, head to China!" But since we live in reality and not Disney, here’s the playbook:

Can’t stop the hurricane, but you can tell it, “Not today, Mother Nature!”

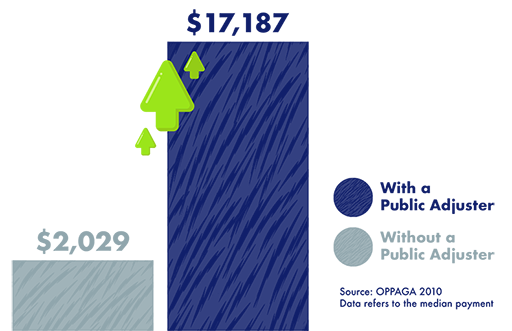

First, the chaos is assessed—walk around, take photos and videos documenting your building’s new "open floor plan." Then you call in the pros: roofers to patch things up, contractors to rebuild what Mother Nature destroyed, a Public Adjuster to help you file the insurance claim and document damage, and maybe an exorcist for whatever’s left.

Water damage? Yeah, that’s its own beast—dry out the soggy mess ASAP before mold sets in and throws a housewarming party. And don't forget the electrical system; one wrong spark and boom, you’re in the sequel.

Finally, file that insurance claim and brace yourself for a long game of "is this really covered?" Bring in a Public Adjuster. They’re like insurance whisperers with a license—calm, collected, and way better at dealing with insurance adjusters than your stress-eating self.

On average, you’re looking at $10,000 to $30,000 for minor hurricane damage—like patching up the roof and drying out your soggy living room. But if your property went full hurricane piñata? We’re talking six figures easy, sometimes upwards of $100,000 to $200,000. Roofs, walls, windows, electrical systems, mold removal—basically, rebuilding your property and your will to live. And let’s not forget storm surges; flooding repairs can send that bill skyrocketing faster than a SpaceX launch. Moral of the story? Hurricanes don’t just break buildings—they break bank accounts.

The lovely cocktail of hurricane destruction falls under a couple of perils: windstorm damage for all that roof-ripping, window-smashing action, and flood damage for when the storm surge turns your property into Atlantis. But here’s the kicker—standard commercial property insurance usually covers windstorm damage, but floods? Oh no, that’s a whole separate endorsement, my friend. Because why make it simple when insurance can make it annoyingly complicated? So, unless you’ve got flood insurance through FEMA or some fancy private policy, those storm surges might leave you drowning in repair bills.

And remember, FEMA’s National Flood Insurance Program (NFIP) isn’t just for homes and soggy basements—it’s got your commercial property covered too. That’s right, FEMA offers flood insurance for commercial properties, which includes coverage for both the building itself and its contents.

Now, here’s the fine print: the coverage limits aren’t exactly billionaire-level. They cap at $500,000 for the building and $500,000 for contents. So, if you’re running a mega-mall or storing gold bars, you might need a private flood insurance policy to fill in the gaps. But for your average commercial setup? FEMA's got your back—well, until the floodwaters rise higher than your policy limits.

A commercial property policy will usually cover wind and some water damage, but don’t expect them to pay for the hurricane turning your office into Waterworld unless you bought extra coverage. Bottom line: your insurance will cover hurricane damage—if you jumped through all the right hoops and paid the extra premiums. And if you didn’t? Well, congrats, your contractor’s new yacht has now been funded.

Get a free insurance policy review with a Tiger Adjuster Public Adjuster!

Commercial property hurricane damage is often characterized by extensive destruction caused by high winds, heavy rain, and storm surges. Roofs may be torn off, exposing interiors to water damage, while walls and windows can be shattered by flying debris. Floodwaters can infiltrate, damaging foundations, electrical systems, and belongings. Structural integrity may be compromised, requiring significant repairs or rebuilding. The aftermath often leaves property owners facing costly repairs, insurance claims, and long-term recovery efforts.

Each year, 1 in every 20 insured homes file an insurance claim with 98% involving property damage.

(Insurance Information Institute, 2021. Claim average from 2017-2021.)

Public Adjusters are licensed insurance professionals trained to interpret your policy, scope and estimate losses, submit your claim, and negotiate with your insurance company to ensure maximum settlement amounts.